Securing the mandatory money to start out or extend a company is usually a significant worry for business owners and entrepreneurs. Certain small business funding might make the difference between a flourishing business as well as a battling just one. The landscape of organization funding is broad and various, featuring numerous possibilities to fulfill the numerous requirements of companies throughout different industries. No matter whether it’s a startup planning to start its initially item or a longtime business aiming to scale functions, small business loans are a standard Answer to financial hurdles.

Knowledge the nuances of organization funding is essential for any entrepreneur. At its Main, company funding entails obtaining fiscal means that a business wants to accomplish its targets. These resources can come from many different sources, Just about every with its own set of benefits and difficulties. Standard organization financial loans from banking institutions and credit rating unions are Probably the most very well-recognised varieties of business funding. These financial loans ordinarily need a good business system, a good credit score, and, in lots of scenarios, collateral to safe the bank loan. The method is usually arduous, but the advantages frequently include things like decreased fascination premiums and the potential for larger sized bank loan quantities.

Assured business funding is not really a just one-measurement-fits-all Option. Different types of companies have various funding demands, and the most effective funding choice relies on the particular circumstances on the company. Such as, startups may possibly find enterprise cash or angel investors far more acceptable, as these sources are more prepared to tackle the higher pitfalls associated with new firms. These buyers offer money in Trade for fairness, allowing the organization to improve with no instant strain of repaying a financial loan. However, this also implies providing up a part of ownership and Regulate.

For enterprises seeking to increase, classic small business financial loans could possibly be extra appropriate. These financial loans can be employed for a variety of purposes, such as buying new gear, hiring extra staff, or opening new locations. The predictability of monthly payments and a chance to approach very long-expression make enterprise loans a sexy choice for several business owners. What's more, securing a company mortgage can help Make creditworthiness, which makes it much easier to receive extra funding Down the road.

The entire process of obtaining certain company funding as a result of a business personal loan normally involves various actions. In the beginning, the enterprise operator should evaluate the level of funding necessary And just how It'll be applied. This requires a thorough idea of the enterprise’s money scenario and foreseeable future projections. As soon as the funding requirements are obvious, the subsequent move is to prepare a compelling organization system. This doc should outline the company’s ambitions, tactics, And exactly how the personal loan will help attain these objectives. A strong enterprise program can drastically enhance the likelihood of securing a bank loan, because it demonstrates to lenders the organization is very well-managed and it has a clear path to success.

Creditworthiness is yet another important Consider securing a business loan. Lenders will review the credit history heritage on the enterprise and its proprietors to evaluate the chance of lending cash. A high credit rating score implies dependability and increases the chance of bank loan acceptance. Firms with inadequate credit history may have to discover alternate funding possibilities or think about means to enhance their credit history just before implementing for any personal loan. Offering collateral, which include house or machines, also can enrich the chances of receiving authorised for any financial loan, mainly because it minimizes the lender's possibility.

In addition to standard financial institution financial loans, there are other sources of organization funding that could be explored. Online lenders, As an example, became significantly popular because of their streamlined software procedures and more rapidly acceptance situations. These lenders normally cater to small companies that might not meet the stringent requirements of conventional banks. Nevertheless, it’s crucial to be aware which the advantage of on the net lenders can feature larger curiosity rates and fewer favorable phrases.

Grants and authorities loans are A further avenue for small business funding. These possibilities are specifically appealing since they normally feature lessen interest premiums and favorable conditions. However, they can be remarkably competitive, and the applying method can be lengthy and sophisticated. Firms must meet up with specific standards to qualify for these funds, and there may be demanding suggestions on how The cash can be used.

Invoice funding is an alternative method of company funding that could be especially handy for enterprises struggling with income stream issues. This includes advertising excellent invoices to some lender in Trade for immediate money. The lender then collects the payment from The client if the Bill is due. This can provide a quick influx of cash without having taking up more personal debt. However, In addition, it signifies offering up a part of the invoice amount of money as a fee towards the lender.

Equity funding is an alternative choice, wherever a company sells shares to boost capital. This can be a powerful strategy to safe substantial amounts of funding with no incurring debt. Having said that, In addition it suggests sharing ownership and probably selection-producing electrical power with new investors. Such a funding is much more widespread in startups and superior-advancement enterprises in which traders are trying to find important returns on their investment.

For companies that favor not to give up fairness or incur personal debt, crowdfunding has emerged as a favorite possibility. Platforms that facilitate crowdfunding allow corporations to boost small quantities of income from numerous men and women, typically in Trade for a products or services. This can be a great way to validate a business idea and produce a buyer foundation. Even so, jogging a successful crowdfunding campaign requires a strong marketing and advertising method and might be time-consuming.

In conclusion, confident business enterprise funding is a multifaceted process that requires careful scheduling and thought. Regardless of whether as a result of a business financial loan, fairness financing, or choice funding resources, securing the mandatory capital is essential for The expansion and achievements of any organization. Each funding selection has its personal set of Rewards and troubles, and your best option depends on the precise needs and circumstances of your business enterprise. By being familiar Assured Business Funding with the different alternatives and preparing thoroughly, entrepreneurs can enhance their probability of securing the funding they need to achieve their aims and generate their companies ahead.

Edward Furlong Then & Now!

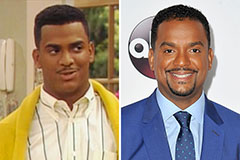

Edward Furlong Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now!